Why Yield Farming on Solana Is More Than Just Hype

Whoa! Ever jumped into the world of yield farming and felt totally overwhelmed? Yeah, same here. At first, it seemed like just another buzzword tossed around by crypto bros, but then I dove deeper and realized there’s a lot more nuance—and opportunity—especially if you’re hanging out in the Solana ecosystem. Something felt off about how people casually dismissed yield farming as just “easy money.” It’s kinda like finding out your favorite dive bar also secretly hosts killer jazz nights—unexpected but legit.

So, here’s the thing. Yield farming isn’t some get-rich-quick scheme. It’s a delicate dance involving DeFi protocols, staking rewards, and a ton of risk management. Initially, I thought it was all about hopping onto the highest APY pools, but then I realized that without the right wallet setup and security measures—well, you’re basically playing with fire. Actually, wait—let me rephrase that—it’s more like juggling flaming torches while riding a unicycle on a tightrope. Not impossible, but definitely requires skill and the right gear.

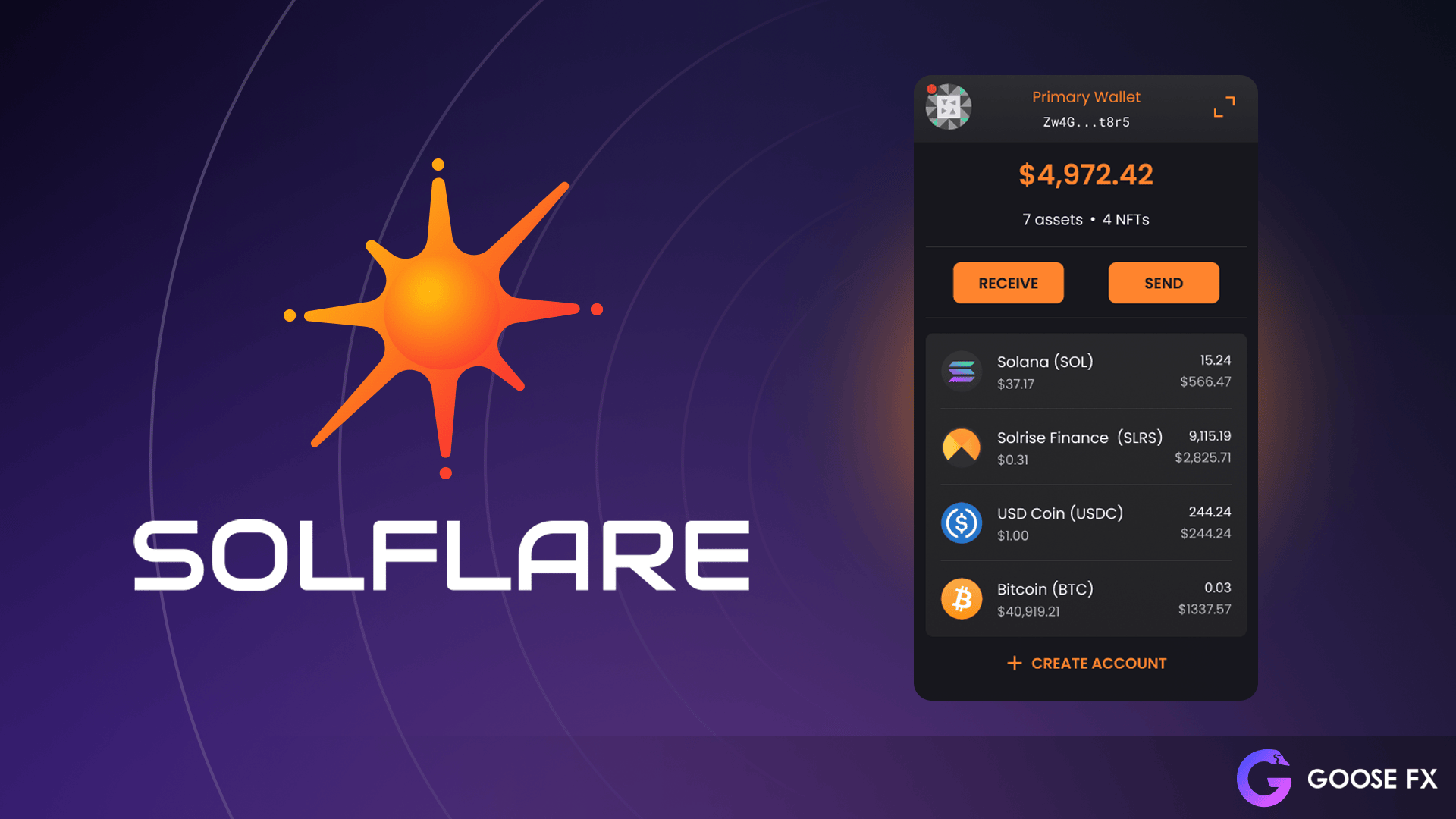

For anyone serious about staking and DeFi on Solana, having a reliable wallet is crucial. I’m biased, but the Solflare wallet really nails this. It’s not just about holding assets; it’s about managing your entire DeFi journey smoothly. You can check it out yourself with the solflare wallet download. That link’s been my go-to when setting up secure access for staking pools and yield farms.

Here’s what bugs me about some other wallets—they often neglect the user experience in DeFi interactions. You end up fumbling with clunky interfaces or worse, worrying about security holes. On one hand, DeFi promises decentralization and control, but actually, if you don’t have a wallet that’s both secure and user-friendly, you’re kinda defeating the purpose.

Okay, so check this out—one thing that really surprised me was how different yield farming protocols handle staking rewards. Some distribute rewards continuously, others in batches, and a few even have complex vesting schedules. It’s not straightforward. This means you gotta stay vigilant about when and how you claim your rewards to maximize returns and avoid unnecessary fees or missed opportunities.

Why Solana’s Speed Changes the Game

On the surface, Solana’s network speed and low fees might just seem like tech specs, but they actually reshape the entire yield farming experience. Seriously? Yeah, because faster transactions mean you can react quicker to market changes without bleeding fees. It’s a huge advantage when you’re farming yields across multiple protocols or jumping between stakes to optimize rewards.

My instinct said this: if you’re farming yields on Ethereum, you’re probably paying a chunk to do so. Solana flips that on its head. However, it’s not a free-for-all. There’s still network congestion and occasional hiccups, so patience is sometimes necessary. Yield farming isn’t a sprint; it’s a marathon with sprints inside it.

Let’s talk DeFi protocols for a sec. Not all are created equal. Some offer straightforward staking pools, others have layered strategies combining liquidity provision and yield farming. The complexity can be overwhelming, and honestly, I’ve seen folks jump in without fully grasping impermanent loss or protocol risk. That’s a recipe for disappointment. But with the right tools—like a wallet designed with Solana’s ecosystem in mind—you can navigate these waters better.

And speaking of tools, the solflare wallet download has been a cornerstone for me and many others. It’s got a slick interface, supports staking directly, and integrates seamlessly with popular DeFi apps. Plus, the community support and ongoing updates make it feel like a living project, not some abandoned app.

Here’s a little tangent—yield farming can sometimes feel like chasing smoke. The APYs look fantastic at first glance, but dig a bit and you realize they’re often temporary incentives designed to bootstrap liquidity. It’s like a carnival funnel cake—sweet and tempting but not something you want to rely on daily. That’s why sustainable staking rewards are more appealing for long-term holders, even if the immediate returns are lower.

Balancing Risk and Reward: The Staking Puzzle

Hmm… balancing risk with reward is the eternal question in crypto, right? Yield farming cranks this problem to eleven. On one hand, staking your tokens in a protocol can feel like locking your cash in a high-interest savings account. On the other hand, bugs, hacks, or sudden market shifts can wipe out those gains overnight.

Initially, I thought diversifying across multiple protocols was the best hedge. Though actually, this approach can backfire if you’re not careful about cross-protocol dependencies or if you’re spreading yourself too thin. Sometimes focusing on a couple of vetted projects with solid track records beats chasing every shiny new farm that pops up.

One strategy I’ve come to appreciate is using wallets that offer integrated analytics and notifications. That way, you’re not just blindly staking—you’re actively managing your positions. This is where the Solflare wallet really shines, in my experience. The way it handles staking rewards and alerts helped me avoid missing out on crucial claim windows. That’s no small deal when you’re juggling multiple farms.

Not gonna lie—there’s also a psychological aspect here. Yield farming can be addictive, and it’s easy to get caught up in chasing the highest APY without considering the underlying risks. I’ve been guilty of that myself. Sometimes stepping back and reflecting on the sustainability of a farm’s incentives can save you from rash decisions.

Oh, and by the way, the community around Solana’s DeFi is pretty vibrant. That social aspect often helps folks get a pulse on which protocols are trustworthy and which ones might be overpromising. It’s kinda like neighborhood gossip but for crypto—valuable intel that’s hard to find just reading whitepapers.

Final Thoughts: Is Yield Farming Worth It?

Okay, so here’s where I land after all this: yield farming on Solana offers real opportunities, but it demands a blend of savvy, patience, and the right tools. The ecosystem moves fast, and rewards can be generous, but it’s not a free-for-all jackpot. You gotta be strategic—prioritize security, pick solid protocols, and manage your staking rewards actively.

For those ready to get their feet wet, starting with a wallet that’s built for the ecosystem is key. Honestly, the solflare wallet download is a solid first step that I’d recommend without hesitation. It balances ease of use with powerful features, making the whole experience less daunting.

Looking back, I started out skeptical, thinking yield farming was just another fad. Now, I’m cautiously optimistic. There’s real innovation here, but it’s wrapped in complexity that can trip up even savvy users. So, if you’re diving in, do your homework, stay engaged, and keep your eyes peeled for those moments when the market shifts beneath your feet. And yeah, don’t forget to enjoy the ride—it’s one heck of a wild west out there.